Ponzi Scheme Fake Investment

Whether you are keen on finance or not, the name of Bernard Madoff certainly means something to you. This real crook is behind a financial scam based on the Ponzi scheme. He gave his name to a pyramid scam scheme that has survived the century and proven itself time and time again (just ask Bernard Madoff). But who was Charles Ponzi and how does his famous pyramid work?

What is a Ponzi scheme?

The Ponzi pyramid is a fraudulent financial scheme that promises very high rates of return to investors, for an extremely low risk taken. The offer is attractive, and consists of generating income for former investors thanks to the financial contributions of newcomers.

The principle of a Ponzi scheme is simple: pay the first investors attractive interest rates using the money of the following. This system is called a pyramid, because it requires increasing the number of investors each year to be able to pay their interest to the first. Thus the money is never invested: the capital is wasted in the form of false interest. At the slightest economics problem, the fall of the system is unavoidable.

This scam owes its name to its inventor, Charles Ponzi, an employee of the Boston post office, who set up the very first scam of this type in 1919.

Since that day, the Ponzi pyramid scheme has been repeated several times, in particular by the former president of the Nasdaq, Bernard Madoff, arrested in 2008 for having set up a pyramid of Ponzi of USD 65 billion.

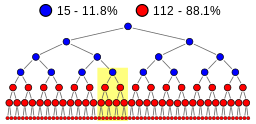

This illustration showing the pyramid structure of the Ponzi scheme; the people at the top of the corporate pyramid (the blues) get the most profits while the people at the bottom (the reds) take on almost all the burdens in exchange for (false) career promises and / or hypothetical future earnings.

Traced by Stannered, Public domain, via Wikimedia Commons

How does a Ponzi pyramid scheme work?

The Ponzi pyramid is based on a totally false and utopian investment system. The concept ? Attract investors and promise them particularly attractive interest rates in relation to the risk taken and their initial outlay.

For example, client A invests USD 10. The company agrees to pay him double two months later. In the meantime, the company is approaching new customers with the same promise.

Clients B invest in turn. Their money is used to pay back the USD 20 promised to client A… and so on!

The Ponzi pyramid scheme is viable as long as a group of customers and they are tempted by these very attractive financial promises. This organization can grow exponentially, until the chain breaks and new investors are harmed (by financial crisis, for example)…

2nd example

A financial company promises you a return of 50% per year. You invest USD 1,000 in it, so you expect to get USD 500 in interest after one year.

12 months later, she actually gives you USD 500. Thanks to her great performance, the company takes a nice compensation, say USD 200. What you don’t know is that your USD 1,000 was never invested , and that all the money distributed comes from this amount.

So there is only USD 300 left in the coffers of the company… However the following year, you expect to receive USD 500 again. investors to replenish its coffers and pay you your interest… Without forgetting that it will then also have to pay their interest.

If a new entrant puts in USD 1,000 again, she can use the USD 1,300 in the bank to pay you your USD 500 in interest and pay her remuneration of USD 200. There will therefore remain USD 600 in the cash box for the following year. . But she will then have to pay USD 500 to her two investors, not to mention her own remuneration. It will therefore have to find other investors to obtain new money.

From year to year, the pattern repeats itself, and the company must always find more investors to pay the interest of the first. Never mind, the excellent yields it is used to serving give it a very good reputation, which attracts new investors.

The system lasts as long as the number of investors grows. But when new entrants become less numerous, or when many investors ask to recover their investment as was the case in the Madoff affair, the chain breaks and the pyramid collapses. Everyone then realizes that he has lost all the capital invested.

How to recognize a Ponzi pyramid scheme?

Several elements make it possible to recognize a Ponzi pyramid:

- the promise of strangely high returns;

- the low volatility and the very limited risk of the investment;

- lack of transparency or confusing explanations of these financial strategies;

- the difficulty of withdrawing the money invested earlier than planned.

Ponzi scheme in crypto

Some actors in the economic sphere, such as Nassim Nicholas Taleb, author of the best-selling book “The Black Swan: the power of the unpredictable”, consider that cryptocurrency has common characteristics with the Ponzi pyramid scheme.

For him, it is too volatile a currency to be used in real transactions. He believes that the latter is based on pure speculation, constantly attracting new investors… According to him, the lure of profit is their main source of motivation, just like those who invest in Ponzi pyramid scheme.

Conclusion

This loss is part of the financial scam these people have fallen into. If they don’t realize the deception, these victims can feel a strong sense of failure. The solution then offered to them to “catch up” is to in turn sell the training to others, which should allow them to earn a commission on each sale. They then begin, without knowing it, to recruit other victims.

Sources: PinterPandai, Investopedia, Investor.gov, The Guardian, CNBC

Photo credit: Pxhere (CC0 Public Domain)