Cash Flow Management

Cash flow management is a must for all businesses. Managing your cash flow well means monitoring the inflows and outflows of money, but also monitoring many indicators to know which strategy to adopt (loans, investments, etc.). Poor cash flow management can quickly put a business at risk. Fortunately, there are solutions for managing a company’s cash flow well. Our experts take a look at the question in this comprehensive article.

What is corporate cash flow?

Cash is all the mobilizable financial resources available to the company at a given time.

The cash flow of a company is a key element of the financial management of the company: indeed, it is the available cash that makes it possible to pay the expenses of the companies: salaries, suppliers, etc.

In business, cash refers to the sums of money that the company has at a given time T.

Therefore :

- cash sums available at the cash desk,

- sums available in the company’s bank account (s).

These funds should be readily available to the business, which can use them to cover planned or unplanned expenses, or finance projects when the opportunity arises. It is this liquidity that makes it possible to pay the expenses of the company: salaries, suppliers, etc.

The cash balance takes into account the inflows and outflows of money. Its calculation can be in excess or in deficit:

- If the cash balance is in excess, it means that the business has cash at its disposal: this is usually a good sign.

- if the cash balance is in deficit, it means that the company is running out of cash and will not be able to cope with certain situations without resorting to borrowing, for example.

Be careful, however: analyzing the cash balance is rarely so simple. It depends on the context of each company: an excess balance can be linked to supplier invoices that the company has not yet paid, for example.

Definition: cash flow management

Cash flow management brings together all the methods and strategies for managing a company’s financial resources. Its objective is to ensure the profitability of the structure, thanks to the monitoring and analysis of indicators.

The scope of action of cash management can include many missions:

- daily monitoring and scoring of cash flow;

- the establishment of budgets and cash flow forecasts;

- the preparation of reports and the monitoring of discrepancies between anticipated flows and proven flows;

- management of banking relationships;

- optimization of costs and financial products;

- the management of the various risks which can threaten the treasury;

- the financing of investments;

- the placement of any cash surpluses…

Too many businesses still just keep track of their bank statements. But this is not enough to anticipate possible cash flow holes, or identify investment opportunities. This is why it is vital to consider cash flow dynamically, to anticipate its development and to know how to interpret it.

What is cash flow management used for?

Avoiding the risk of default payement

A business that is no longer able to settle its short-term debts is a business in default. Often times, this amounts to his death (or at least puts him in serious trouble).

Fortunately, managing your business’s cash flow can save you from hitting the wall. By setting up regular monitoring (keeping an up-to-date cash budget for example), you will have much better visibility on your current cash flows as well as your forecasts. This will allow you to identify in advance the cash flow mismatches that could harm your finances and then take the necessary measures.

Save money (bank charges, intervention fees, etc.)

Still not convinced? Good cash management can save money on bank charges: loan interest, agios, intervention fees, etc. A company that exceeds its authorized overdraft will in fact have to pay premiums, to which are added intervention fees. If the leader manages his cash flow effectively, he will be able to determine the periods when he will really need to finance his cash flow and will have time to put in place less expensive financing.

Earn money by investing your excess cash intelligently

While negative cash flow puts additional costs on the business, misplaced excess cash is also not optimal.

You should know that banks offer a wide range of offers for those who wish to invest excess cash, all depending on the objectives of each manager:

- Investing the excess in order to profit from it over time

- Place the surplus in anticipation of financing an investment

- Invest the excess in order to have a safety reserve in the event of a hard situation

But for that, it is still necessary to know that the company has generated this surplus! And guess how it is possible to shed light on such a situation?

By using a provisional cash flow plan and monitoring its development regularly.

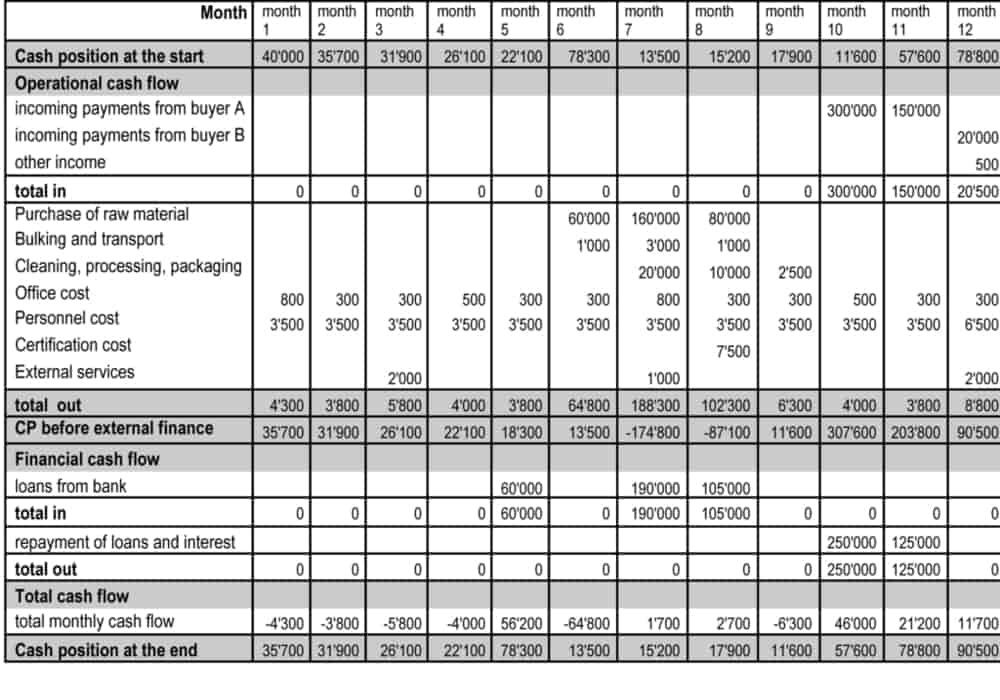

Cash Flow Statement Template

| [Company Name] | ||

| Cash Flow Statement | ||

| For the Year Ending | 31/12/2019 | |

| Cash at Beginning of Year | 15 700 | |

| Operations | ||

| Cash receipts from | ||

| Customers | 693 200 | |

| Other Operations | ||

| Cash paid for | ||

| Inventory purchases | -264 000 | |

| General operating and administrative expenses | -112 000 | |

| Wage expenses | -123 000 | |

| Interest | -13 500 | |

| Income taxes | -32 800 | |

| Net Cash Flow from Operations | 147 900 | |

| Investing Activities | ||

| Cash receipts from | ||

| Sale of property and equipment | 33 600 | |

| Collection of principal on loans | ||

| Sale of investment securities | ||

| Cash paid for | ||

| Purchase of property and equipment | -75 000 | |

| Making loans to other entities | ||

| Purchase of investment securities | ||

| Net Cash Flow from Investing Activities | -41 400 | |

| Financing Activities | ||

| Cash receipts from | ||

| Issuance of stock | ||

| Borrowing | ||

| Cash paid for | ||

| Repurchase of stock (treasury stock) | ||

| Repayment of loans | -34 000 | |

| Dividends | -53 000 | |

| Net Cash Flow from Financing Activities | -87 000 | |

| Net Increase in Cash | 19 500 | |

| Cash at End of Year | 35 200 | |

Cash management: who does what?

All businesses are concerned with managing their cash flow. Workload and available human resources vary from company to company. A multinational will have a lot more cash to manage than a new start-up, and a small business will have a lot less staff trained to manage its cash flow than a large group.

The role of the leader

The manager of a company needs to know his cash flow situation and to measure the impact of his decisions (investments, recruitments, etc.) on his profitability and future cash flow. Good cash management should enable him to make the best decisions for his business, in the near future and beyond.

But if the company is small, with no finance function, it is he who will fulfill all the roles described below!

The role of the CFO

The administrative and financial director manages the company’s finance team and reports to the executive. Its role in cash management is to monitor indicators in real time and reliably, in order to be able to alert the manager in the event of a cash flow problem and advise him on the decisions to be taken and the actions to be implemented.

The role of the treasurer

The treasurer is the one who manages the treasury on a daily basis. He is responsible for monitoring cash flows, drawing up forecast budgets, analyzing various indicators, relations with banks, validation, etc. His role is essential because he has an overview of liquidity and the profitability of the company.

The role of the accountant

In general, we say that accounting is an analysis of the past, while treasury looks into the future.

If there is no treasurer, the accountant will carry out the cash management missions. If there is a treasurer, he will rather fulfill the function of providing the data: invoices, balance sheet, income statement …

The role of the financial controller

The management controller has his role to play in cash management because he is in charge of the budgets for each activity or department of the company. It will therefore provide the information necessary to build the cash flow forecast.

The role of the treasurer

The treasurer is the one who manages the treasury on a daily basis. He is responsible for monitoring cash flows, drawing up forecast budgets, analyzing various indicators, relations with banks, validation, etc. His role is essential because he has an overview of liquidity and the profitability of the company.

The role of the accountant

In general, we say that accounting is an analysis of the past, while treasury looks into the future.

If there is no treasurer, the accountant will carry out the cash management missions. If there is a treasurer, he will rather fulfill the function of providing the data: invoices, balance sheet, income statement …

The role of the financial controller

The management controller has his role to play in cash management because he is in charge of the budgets for each activity or department of the company. It will therefore provide the information necessary to build the cash flow forecast.

Understanding Negative Cash Flow: Causes, Consequences, and Solutions

Daily cash management

Analyzing your cash flow once at the start of the month and only coming back to it 30 days later is not enough. Get in the habit of monitoring your cash flow from day to day: cash receipts and disbursements must be closely monitored.

Bank reconciliation

Bank reconciliation is a check that aims to verify that the invoices issued or received by the company have indeed resulted in the corresponding movements on the company’s bank accounts.

Identify your cash position

The cash position refers to the statement of cash at a time T. Often the most practical is to start from the cash available at the end of the annual balance sheet of the company. But if the cash flow monitoring is rigorous, it is also possible to start from a monthly cash balance, which will be taken from the monitoring table.

Free Cash Flow (FCF) | Explanation, Method of Analysis, Examples, Questions, Answers

Cash management: how to anticipate the future?

Make cash flow forecasts

Not forecasting cash flow is like driving on an icy road. It is for this reason that establishing a provisional cash flow plan is essential, in order to regularly monitor and adjust the company’s strategy. The provisional cash flow plan enables the company manager to be informed of future cash flow problems, and therefore to anticipate them.

Forecasting through the cash flow plan is not an end in itself. This document should be regularly updated based on actual cash flow and changing objectives.

Consider all scenarios

For optimal cash management, especially at the projection level, the company should consider all possible scenarios. Loss of a customer, late payments, drop in demand … or conversely: sudden increase in orders, rapid growth … All possibilities must be considered, with elements of response to be provided for each scenario (financing external, heavy investment…).

One of the main risks is that the company has an overly optimistic view of its future, especially for young companies that have yet to find their feet in cash flow. One will think in particular of the confusion which quickly arises between a high turnover and a positive cash flow situation: one does not necessarily go with the other!

Key cash management indicators

Available cash

Free cash flow is the money you have at any time T on all of your bank accounts. It is essential to monitor this indicator, but also to forecast its development by making cash flow forecasts. Being able to determine your forecast cash flow fairly precisely will allow you to react in advance if necessary (and therefore avoid an impromptu cash “hole”).

In order to validate the relevance of your cash flow forecasts, we also recommend that you regularly compare your forecasts with what has really been achieved.

Also read: Payback Period | How do you calculate the payback time on your investment?

Net cash consumption

It corresponds to the following formula:

Net consumption over a given month = Disbursements of the month – Receipts of the month

or

Net cash consumption = Total Cash Inflows – Total Cash Outflows

Starting from the data contained in your cash flow table, you can follow month by month if you “consume” cash (ie if you have more expenses than income) or on the contrary if you accumulate cash. .

Positive consumption can have several causes: exceptional (investment, occasional drop in receipts), or structural (current charges exceeding current revenue). Either way, you have to be careful not to let the situation drag on.

WCR / Cash flow requirement

Working Capital Requirement (WCR) represents the amount of money a business needs to cover its cash flow mismatches between receipts and disbursements (called the operating cycle).

Regular monitoring of this indicator makes it possible to know how the company’s cash flow needs are changing.

The WCR should be analyzed since a company may experience an explosion in its activity but still face cash flow difficulties.

If we take a company that is experiencing a sharp increase in its activity while allowing payment terms, this will generally increase the working capital: larger stock, hiring to have more manpower, purchases of additional machines.

Except that…

Keeping this stock weighs on the cash flow since the goods have already been paid for but will not be sold until later.

Thus, the company must have sufficient working capital to finance all of this while awaiting its expected cash receipts which will restore balance.

Note: an increasing WCR is not necessarily a sign of cash flow difficulties. On the other hand, the company must make sure that it can deal with it properly.

Managing your cash flow well: why is it so difficult?

Many companies face difficulties in managing their cash flow. And for good reason: treasury is a complex discipline.

Cash management: many elements to take into account

Receipts, disbursements, down payments, assets, credits, loans, payment terms … These are all elements that make cash management more complex, especially if you follow their progress manually via an Excel table or paper documents!

Accessing information can be complex, especially if your company processes a large volume of cash flow across multiple bank accounts. Accessing a consolidated view of its cash flow then turns out to be an impossible task.

Cash management: the work of the chartered accountant?

The business manager will naturally turn to his accountant or accountant for information on the current and future state of his cash flow. However, treasury and accounting are two different concepts! It will be difficult for the accountant to give you real-time information on your cash flow.

Read also: Why shouldn’t we confuse the accounting view and the cash flow view?

Cash management: a time-consuming task

Check cash receipts and disbursements on a day-to-day basis, develop and update cash flow forecasts, issue reports and interpret indicators … Cash management is a task that requires time and daily investment.

Cash management: the limits of Excel

Excel is a very powerful software, but it lacks flexibility of use, real-time updating and reliability. The more human interventions there are, the longer the processing time can be, and the greater the risk of error: no one is perfect! And these errors will probably not be detected until several months later, which will take a long time to correct them.

Sources: PinterPandai, Corporate Finance Institute, Bench, Accounting Tools

Photo credit: Oftcc / Wikimedia Commons (CC BY-SA 3.0)

Capital Budgeting Techniques: Making Smarter Investment Choices