Crypto Mining

If you are interested in cryptocurrencies, you must have heard of Bitcoin and its underlying technology, the blockchain. But you may also have heard of crypto mining. Like the blockchain, mining can seem complex at first glance. However, it is one of the most important concepts to know in the world of cryptocurrencies.

It is indeed the process that makes it possible to carry out and validate transactions for a certain number of crypto-assets (including Bitcoin). So how does cryptocurrency mining work? Can you too start mining cryptocurrency and making money from it? We will see all of this together in the following article.

What is cryptocurrency mining?

Mining refers to the process of earning cryptocurrencies by solving complex cryptographic equations using the computing power of computers. This resolution process allows the verification of a block of data, as well as the addition and recording of it on the blockchain.

The miner is the person who takes care of this process by providing the computing power of his computer in order to solve these equations and validate the transactions. To reward him for his participation in the proper functioning of the network, the miner receives a payment with the mined cryptocurrency. For example, by mining Bitcoin, you will receive Bitcoin.

The difficulty of the equations to be solved to validate the transaction depends on the number of people who mine a given cryptocurrency. Thus, the more miners there are, the more the difficulty increases and the more computing power is required.

For each validated transaction, the miner receives a payment in the cryptocurrency in question. However, this reward system is different depending on the crypto-asset.

The reward can be decreasing as is the case for example with Bitcoin. Indeed, every four years, the reward granted to the minor who validated transactions is halved.

This is called a “halving”. This makes “mining” Bitcoin more and more difficult over time. The reward can also be known in advance. That is to say, it will be the same for each validated transaction.

There is also a reward creation system. Indeed, some crypto-assets provide that a predefined percentage will be created each time a transaction is validated in order to reward miners.

We can also find a mining model that is based on taking a commission on transactions. Thus, a percentage of each transaction made with the cryptocurrency is intended to reward the miners. Finally, there is a hybrid system that mixes the last two reward systems mentioned.

The different types of consensus

To validate transactions on a decentralized network, different mechanisms exist. The best known are proof of work and proof of stake. We are going to look at these two mechanisms in order to understand how they work.

Proof of work

In order to validate the transactions, several methods exist. The best known is undoubtedly the Proof of Work (PoW).

Proof of work was invented by Adam Back, a British cryptographer. Originally, proof of work served as a spam filter. Indeed, the sender of the mail had to provide a proof of calculation which required a small amount of time and electricity.

This process, painless for individuals, made it too expensive to send large quantities of emails. This therefore made it impossible to send thousands of unwanted emails.

This invention was taken up by Satoshi Nakamoto when he developed Bitcoin. The calculations performed by miners can be performed using processors such as graphics cards.

Proof of work is a very efficient protocol for validating transactions in a decentralized network. The problem with this validation mechanism is that it requires huge computing power from miners. Indeed, the cryptographic equation to be solved has no other use than securing the network and consumes a lot of electricity.

Proof of Stake

In order to solve this problem, Proof of Stake (PoS) is increasingly used by blockchain projects. This consensus mechanism is based on participants locking tokens.

The right to validate a block is then randomly assigned by the protocol to one of the participants. The more tokens you have locked, the greater your chance of being chosen to validate the block.

Thus, it is possible to produce blocks in a less energy-consuming way. The tokens staked by participants (their stake) incentivize them to maintain security on the network. Indeed, if they fail in this task, their bet can be partially or totally destroyed.

Other validation mechanisms

There are several variations of the proof-of-stake validation mechanism. We can for example cite the Delegated Proof of Stake (DPoS) used in particular by the Tezos blockchain.

DPoS works in much the same way as proof of stake, except that it gives a token owner the possibility of delegating them to another network user (a validator). Thus, the latter will have more chances of validating transactions on the network. In exchange, they will donate a percentage of the reward to the user who delegated his tokens to him. The great advantage of this validation mechanism is that it allows a high throughput of transactions.

We can also give the example of Proof of History (PoH or proof of history) used by the Solana blockchain. With this mechanism, the network nodes timestamp the transactions with cryptographic proofs (time and time recording) which allows for faster block validation.

Finally, there are hybrid systems that use several validation consensuses. In addition, new validation mechanisms are created regularly. Thus, there are more and more ways to mine cryptocurrencies.

How to mine cryptocurrencies easily and with what hardware?

If you want to dedicate yourself to cryptocurrency mining, you should know that there are different ways to achieve this goal. First, we will introduce you to the different ways to mine cryptocurrency with hardware.

Invest in a cryptocurrency mining farm

Previously, it was possible to mine using your personal computer. Early Bitcoin miners used either their CPUs or their graphics cards or sometimes both at the same time.

Indeed, individual miners have since been replaced by mining farms. Mining farms are large sets of computers dedicated to this activity and which are generally found in warehouses.

Most mining farms are located in countries where the price of electricity is particularly attractive. In this way, mining is practiced in an industrial way and represents the majority of the computing power of the Bitcoin network.

Invest in a cryptocurrency mining platform

That being said, it is still possible for an individual to mine using a computer specially assembled for this purpose. This assembly of components is called a “mining rig” or mining platform.

Mining rigs allow you to mine much faster than traditional computers. Indeed, a mining platform is generally only composed of a frame containing a large number of graphics cards and processors. This assembly is also designed to be optimally ventilated.

Mining cryptocurrencies with an ASIC

It is also possible to use a computer specially manufactured for mining cryptocurrencies, an ASIC (Application Specific Integrated Circuit or integrated circuit specific to an application).

This computer is intended for one and the same task for which it excels: the mining of crypto-currencies.

On the other hand, this material is very expensive to buy and it can quickly become obsolete. Indeed, it is enough for the validation mechanism to change for this acquisition to no longer be useful. In addition, an ASIC requires regular maintenance.

Staking, the simplest solution to “mine” crypto-currencies

Staking consists of acquiring a cryptocurrency and keeping it in an online wallet in order to validate the transactions carried out on the blockchain.

As seen previously, with a validation mechanism such as proof of stake, the good health of the network is linked to the holders of the cryptocurrency. These are rewarded (for putting their capital into play) through a randomly assigned reward based on the amount of locked tokens.

Thus, staking simply consists of buying a cryptocurrency and then blocking it through a wallet that supports such a practice. This is without a doubt the easiest way to earn cryptocurrency (it’s not actually mining) and thus obtain regular passive income.

How to stake cryptocurrencies? (Alternative to mining)

Many platforms offer you staking against very high return promises. However, many players are unreliable and you should do extensive research to ensure the reliability of the company you entrust your cryptocurrencies to.

Crypto mining software

Easy Miner

EasyMiner is an open source CPU miner for Litecoin, Bitcoin and other cryptocurrencies. It supports the getwork mining protocol as well as the Stratum mining protocol and can be used for both “solo” and “pool” mining.

Nicehash Miner

Available on the market since 2014, NiceHash is an online brokerage firm based in Ljubljana, Slovenia. The platform offers mining, trading and exchange services on the crypto market. Its production servers are available in India, Brazil, China, the US and the Netherlands.

In fact, NiceHash allows miners to earn cryptocurrency through mining. Also, crypto exchanges are designed to facilitate the buying and selling of Bitcoin, Ethereum, and altcoins.

In addition, the NiceHash site is available in several languages, including English, French, Russian, Portuguese, Spanish and German. Moreover, it claims to use powerful algorithms for mining such as: Equihash, CryptoNight, Scrypt, Lyra2REv2…

Ecos

Grow your cryptocurrency investment with the ECOS platform! For this you will have to create an e-wallet with this tool. Investors will have more profit on this platform. Indeed, they can leverage all digital assets with quality tools.

Is crypto mining profitable?

The profitability of crypto mining varies according to several criteria. First, mined cryptocurrency.

Indeed it is only possible to mine one crypto-currency at a time with a given equipment. Knowing that the equipment necessary for this activity requires a certain initial investment, it is important not to make a mistake in this choice.

You must choose a cryptocurrency where competition is limited in order to ensure relative ease of mining. But this crypto-currency must also be valued by the market and remain at a certain price, which makes the equation difficult. Next, you need to choose the right material.

The more powerful and suitable the hardware used, the more chances you have of winning your chosen cryptocurrency. The price of electricity must also be taken into account in your calculations.

Unsurprisingly, mining consumes a lot of energy and requires a lot of electricity. Thus, countries with surplus electricity production have a major competitive advantage when it comes to mining cryptocurrencies.

Other ways to do crypto mining

Now that we have seen the hardware solutions that allow mining cryptocurrency, we will see how it is possible to perform such an operation without a machine. Indeed, there are alternative methods that we will present to you in the rest of this article.

Mining cryptocurrencies with cloud mining

Cloud mining is a mechanism for crypto mining, by renting computing power from a cloud server. Thanks to this type of service, you will not have to install anything or worry about the proper functioning of the hardware and software used.

Cloud mining companies allow individuals to open an account and participate in the cryptocurrency mining process remotely. However, the initial investment is generally quite high and must be paid in advance in order to finance a contract that runs over several years.

Invest in a masternode to mine cryptocurrencies

It is also possible to mine cryptocurrencies via masternodes. Indeed, blockchains using proof of stake as a consensus mechanism work thanks to this system. The masternode (literally master node) is a computer term used to describe the pillar machine of a network, that is to say the one through which communications pass. The masternode is what is called a full node. In this, it validates and transmits transactions over the network.

Thus, if you have a masternode, network users will pass their transactions through your structure. You will then be paid according to the commissions made on these transactions, which will ensure you a high level of remuneration.

However, owning a masternode is not within everyone’s reach. Indeed, creating a masternode requires a minimum number of crypto-currencies in question.

And as you might expect, the more popular the asset, the larger the initial investment will need to be.

Beyond the initial financial investment, it should also be borne in mind that masternodes have a great responsibility because they host all the transactions carried out on the blockchain in question. They also have a governance role and participate in decision-making on the network.

Thus, being a masternode and therefore a validator of a network involves a considerable investment of time but also advanced computer knowledge.

Staking, the simplest solution to “mine” crypto-currencies

Staking consists in acquiring a crypto-currency and keeping it in an online wallet in order to validate the transactions carried out on the blockchain.

As seen previously, with a validation mechanism such as proof of stake, the good health of the network is linked to the holders of the cryptocurrency. These are rewarded (for putting their capital into play) through a randomly assigned reward based on the amount of locked tokens.

Thus, staking simply consists of buying a cryptocurrency and then blocking it through a wallet that supports such a practice. This is without a doubt the easiest way to earn cryptocurrencies (it’s not actually mining) and thus obtain a regular passive income.

Conclusion

Mining consists, by testing an enormous number of combinations, of what figure could generate the “hash” of a given transaction. The first miner who finds the solution provides a “Proof of Work” which certifies that he has found the solution to the problem. He collects a commission – a small percentage of the transaction he has validated and also, regularly, new Bitcoins. This is where the analogy with traditional currency mining comes from, since this work regularly results in the creation of new BTC.

Ethereum Ξ | Explanation, How to Buy, How it Works and the Wallet?

Important information: All investments involve some degree of risk. As a general rule, you should only sell and buy or trade financial products that you are familiar with and understand the risks associated with. You should carefully consider your investment experience, financial situation, investment objectives, level of risk tolerance and consult your independent financial advisor regarding the appropriateness of your situation before making any investment.

Sources: PinterPandai, Just Mining, Bankrate

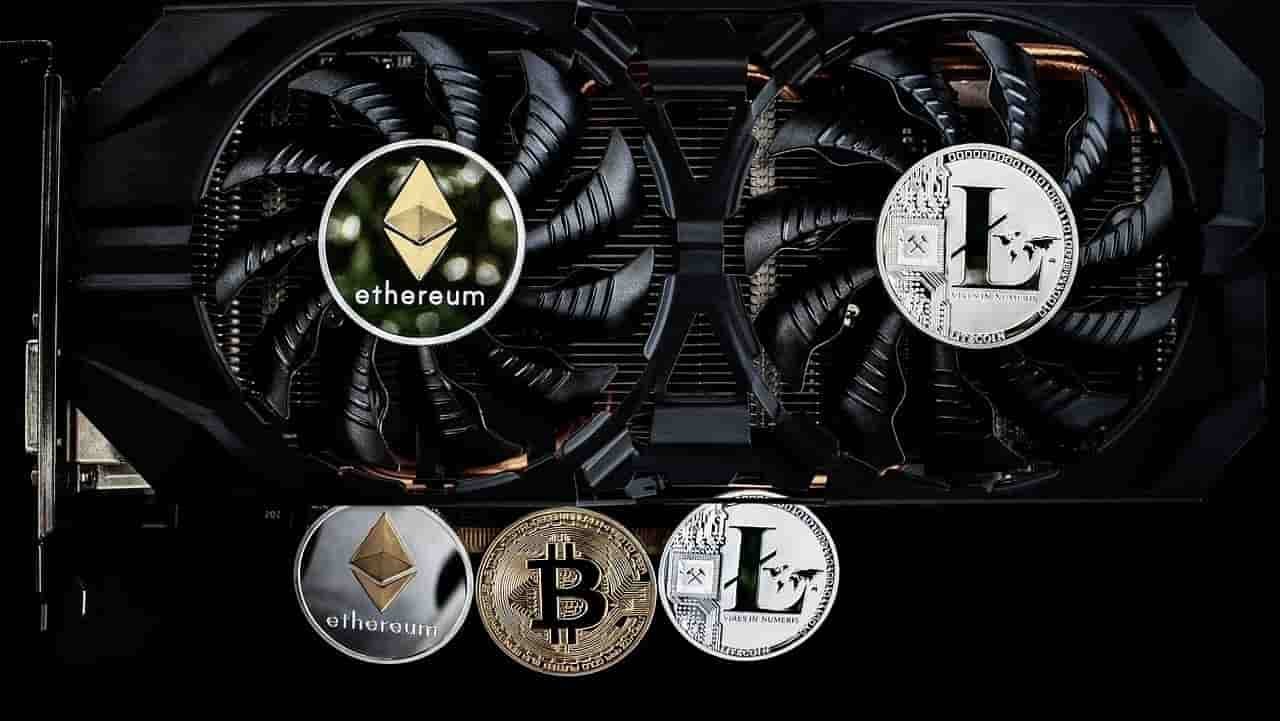

Photo credit: WorldSpectrum / Pixabay